* Half of remittances used for day-to-day family needs and bill and loan repayments.

* 82% of receivers say that they, not the senders, decide how the money will be used.

* 41% say the expectation of receiving remittance places emotional stress on their families.

As global remittances hit record highs, a new report by UniTeller of low-income adults in the Philippines reveals the value of monthly remittances from family and friends working abroad now averages more than 2.5 times the monthly incomes of recipients.

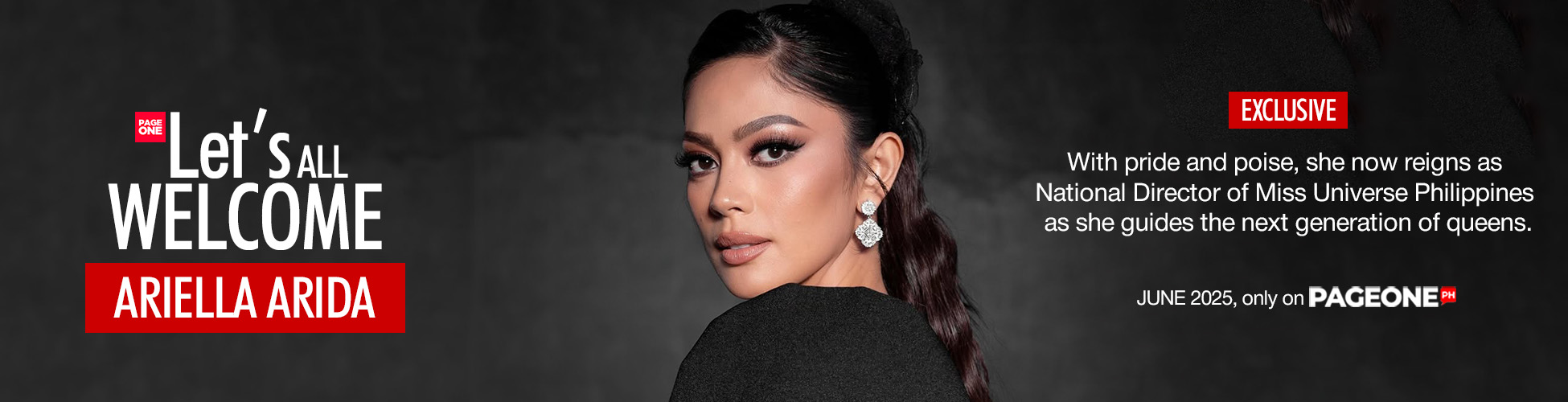

The report, titled Both Sides of the Coin: The Receiver’s Story, is the first instalment of UniTeller’s research into the behaviours and attitudes of low-income remittance recipients in the Philippines, India, Indonesia and Vietnam regularly receiving money from senders in Hong Kong, Singapore, and the United States.

It finds the average monthly remittance value sent back by low-income overseas Filipino migrants is US$446, compared to their receiver’s average monthly household income of US$175. The Philippines is the fourth largest remittance destination in the world with US$34 billion of inflows in 2018. According to the Bangko Sentral ng Pilipinas (Central Bank of the Philippines), personal remittances from overseas Filipinos reached a high of US$2.9 billion in the month of August 2019 and personal remittances for the first eight months of 2019 were estimated to be some US$22 billion.

ALBERTO GUERRA, CEO UNITELLER, SAID: “With global mobility increasing, remittances are playing a more important role in the livelihoods of low-income families and communities. As the reliance on remittances grows, a key challenge is ensuring this income translates to building sustainable wealth.”

POOR FINANCIAL PLANNING AND RISING OVERDEPENDENCE

According to the report, half of remittances received by Filipino households are used for day-to-day family needs (25%) and bill and loan repayments (25%). The report also reveals that much smaller sums are being apportioned to areas that may further economic progress, including education (13%) and savings (13%), and relatively high amounts are spent on non-essential luxury items (7%).

This poor financial planning is exacerbated by almost one-in-five (19%) of remittance recipients in the Philippines saying they regularly run out of money.

Nearly three-quarters (72%) of Filipino recipients say they will reach out to the sender when they run out of the money they receive, with 53% saying they will ultimately have to forgo day-to-day needs if this happens.

The survey further finds that a reliance on remittances may also placing increasing stress on the relationship between senders and receivers. Two-in-five (41%) report that the expectation of receiving remittance places emotional stress on their family and over half (54%) say that it impacts their relationship with the sender.

When it comes to who calls the shots on financial planning, 82% of receivers say they have the final say on how remittance funds are allocated. This suggests a considerable level of trust in the decision-making capabilities of the recipients. This view is supported by the survey result that 93% of recipients kept a close track of their savings and expenses.

NOEL CRISTAL, UNITELLER PHILIPPINES COUNTRY PRESIDENT, SAID: “As a global remittance company, it is important for us to go beyond data and to fully understand the behaviour and needs of both the senders and recipients of overseas transfers. Our report shows that the drivers and influencing factors for senders and recipients have shifted significantly as mobility has increased. These changes have been brought about by changes in mind-set, advancement in technology and even limitations within the local infrastructure.”

Although the report highlights that receivers do not allocate enough of the remittances to savings, there are untapped opportunities to increase their capacity in building sustainable wealth. Three-quarters (75%) of regular remittance recipients in the Philippines say they are extremely eager to learn and cultivate good financial habits.

THE DAWN OF DIGITAL

As a sign of growing digitalisation of financial services in the Philippines, the survey reveals that 78% of respondents have a mobile wallet account and 97% have a smartphone. Despite this, the most common method of receiving international money transfers is still via cash pick-ups (67%), followed by electronically into an existing bank account (41%) and mobile wallets (29%).

Indicating the appetite for this to change, 88% are receptive to a semi-digital payments solution that would allow them to initially confirm the transaction online and then subsequently fulfil the transaction at a physical location.

Amid these changes, concerns around cyber security are a rising issue, with 71% of the respondents expressing this as an issue, followed by concerns around processes being too complex at 57% and not being able to receive funds at 56%.

MR CRISTAL CONCLUDED: “We can see immense opportunity for the digitalisation of remittance services to make peoples lives easier. Many overseas workers have families that reside in provinces, outside of urban centres where physical services are more accessible. Similarly, for senders there is a high time cost, with remittance services often requiring them to physically go to a location and queue on their day off. It’s firmly on our radar in the coming year to work more closely with our public and private sector partners to enable easier access to remittance services and look at how we innovate our offering.”